Uncover the real objectives and value of an account plan with the help of an easy-to-use template. You can download this account planning template for yourself or your team.

How to Do Account Planning That's Actually Useful

Course Contents

Account Planning Fundamentals

It's difficult to get on board with the idea of useful account planning if you don't really understand what account plans are supposed to do. So, what is the real goal of an account plan and how does it help to structure the sales process?

First of all, while we call it an account plan, it's really more of an account strategy. Plans are like instruction booklets or how-to guides. Strategies, on the other hand, dig deep to answer the other questions like what, why, when, and who. Strategies leverage data and insights to achieve objectives.

An effective account plan or strategy should do the following four things:

- Document your customers' or prospects' strategic priorities.

- Identify ways for you to connect with buyers by aligning your use cases with their strategic priorities.

- Map out an investment strategy for a mutually beneficial long-term relationship.

- Detail the specifics (the who does what and when) of that engagement in a clear plan.

When you complete all four of these steps in the account plan, you will have a strong foundation of data-based insights into the account. This means you and your team will have completed a whole lot of upfront research that will serve you in every interaction you'll have on the account going forward.

Another benefit of this process is that you'll have comprehensive knowledge of your client's business and financials. All of that upfront research will teach you important specifics about the account's business health - how do they create value, where are their pain points, where are their executives focused and investing, and what are their planned initiatives?

On top of that, you'll have a strategic relationship roadmap designed to support and grow your relationship with the client over time. The work you're putting in is for way more than a one-time transaction. You're preparing a tactical, detailed plan for how to expand the account relationship over time through multiple high-dollar deals that drive serious value for the customer.

This sounds great, but where do you start? There's a reason sales teams devote a month or more to account planning - it's a journey, and like any journey, it requires adequate preparation. What does that mean? Research, research, research. There's no way around it, so don't skimp. Research is the foundation of everything in the account plan and beyond.

We'll go into more detail in subsequent videos, but prepare to dive into things like financial reports, earnings call transcripts, and more. And you need to use the right template. We've provided a download on this page for the account plan template you'll see used in this series.

The template consists of three slides, each of which will be explained in the next three videos. An important thing to note is that this template helps you create both internal and customer-facing deliverables. This is definitely not an account plan you'll review once and then hide on the shelf.

This might be different from how you've approached account planning in the past, but remember, you're trying to change the process, right? Following this structure will ensure you're on the right track to creating an account plan that's actually useful.

Align Customer Priorities With Your Use Cases

Hear why alignment between your use cases and your customer’s strategic priorities positions you for better buyer engagement.

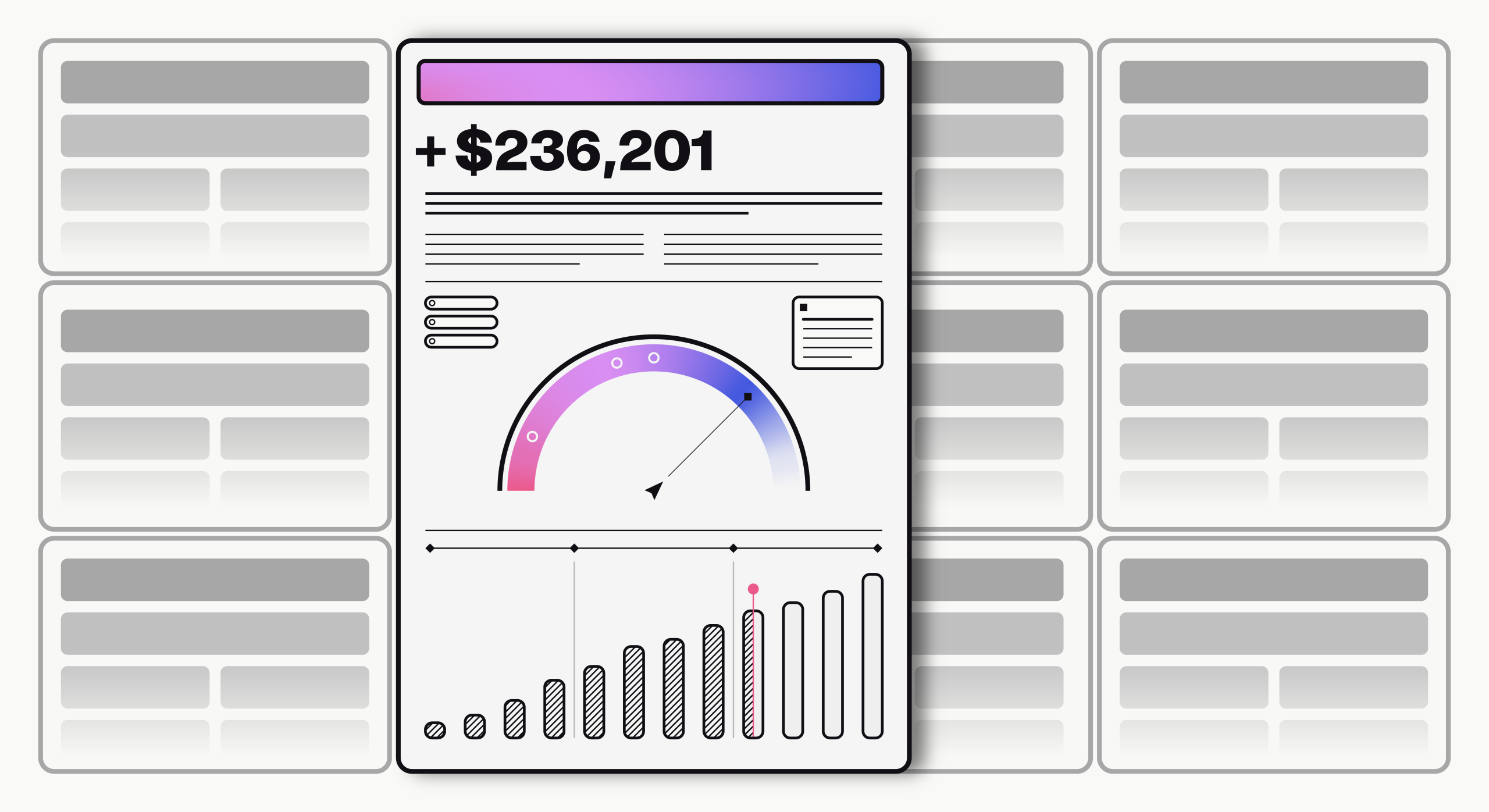

This is the most important slide in the account plan template because it shows exactly how your solution's use cases map to the customer's strategic priorities, performance goals, and operational objectives. As you work to complete this section for your internal use, remember that this will also be a great slide to show customers so they can visualize how your company will drive their highest priority business outcomes. It also forms the basis for the second slide in the template, the investment strategy, which we'll explain in the next video.

In this slide, a fictional AI software company called Robobrain is working on an account plan for Nike. Note that there are five areas covered in the matrix. Let's walk through what they are and where you find the data needed to complete each area.

Strategic priorities: The first column of the table is where you'll list out the company's strategic priorities. These are the initiatives or efforts that matter most to the company right now. To find those strategic priorities, you have several options. If you're a Databook customer, the platform automatically provides a list of the company's strategic priorities. If you're not a Databook customer, you can still find this information; you just have to do a little extra legwork.

Check investor and financial reports, i.e. the 10K and the annual report (assuming you're looking up a publicly traded company). You can either find these on a company's investor relations page or their website or search directly through the SEC's website. Read earnings call transcripts, which are also typically available on a website's investor relations page or through several independent online aggregators. Investor presentations, and don't stop with financial documents; read current news headlines for the company and its industry at large. Draw from your team's past experience, conversations, or research. While reviewing these documents, use the control F or command F on Mac shortcut to search for keywords like strategic priorities or strategic initiatives. You can also search directly for an executive's name because if the C-suite is talking about something, it's usually important.

In this example, you can see that Nike had three primary strategic priorities at the time this account plan was written.

Value drivers: In the next column, you'll list out the value drivers impacted by each strategic priority. Value drivers should be a subset of the top-line financial metrics that drive shareholder value in the company's industry, such as revenue growth, gross margin, SG&A, capital efficiency, and so on. If you're a Databook user, the platform provides a ready-made value driver tree for the company's industry. Simply go to the company's page and navigate to the overview page under financials in the top menu. If you're not a Databook user, you can typically uncover this data by thinking through how each priority impacts the company's KPIs until you get to the top-level metric driving value in the form of revenue or cost of operations. For example, in our Nike and Robobrain scenario shown here, the strategic priority around creating more premium, consistent, and seamless user experiences directly impacts customer acquisition, retention, and lifetime value, which in turn drives revenue. So, the associated value driver for this strategic priority should be revenue growth.

Performance targets: Moving to the next column, you'll now input any specific performance targets executives have communicated that align to the value drivers you just listed. Earnings call transcripts are a great place to locate this information. Specifically, look at the transcripts for Q4 and Q1, where executives, typically the CFO, often provide their guidance and strategic priorities for the fiscal year ahead. In the example shown here, you can see that Nike has a number of important performance targets to hit.

Operational objectives: Next, you'll list the specific tactics that executives have stated will help them hit their performance targets and achieve their strategic priorities. Earnings calls are again a great resource for finding these objectives, usually near any mention of performance targets.

For example, the CFO might say, "We're going to leverage enhanced data and analytics capabilities to optimize inventory, drive higher full-price realization, and lower digital fulfillment costs. As a result, we're hoping to achieve gross margins in the high 40 percent range by the next fiscal year."

At this point, you've documented the customer's or prospect's strategic priorities, along with how they plan to achieve those priorities and the targets they've set to hold themselves accountable to shareholders. Now it's time to see how your company can help drive these plans forward.

Use cases: In the final column, input any and all of your solutions' use cases that align with the previous four columns. Use cases are statements of how your solution can be applied to solve a business problem. They provide tangible ways to connect with your buyers around the specific priorities and objectives.

Include as many use cases as you think are relevant. The more you have, the bigger the opportunity and potential value for the customer. Databook users can find a list of relevant use cases on the company's highlights page. Data Book rates each use case as a strong, medium, or weak match and maps to specific value drivers and strategic priority keywords to help you select the right set of use cases.

In our completed slide here, you can see that Robobrain has a number of relevant use cases that align directly with Nike's priorities, value drivers, performance targets, and operational objectives. Nike has some great opportunities to connect, and the account plan is off to a great start.

The Investment Strategy

Learn how to build an investment strategy that demonstrates a strategic relationship with your buyer.

Now that you've clearly mapped out a path for connecting your use cases to the strategic priorities most critical to the account, it's time to focus on how you can translate that connection to a strategic relationship that's mutually beneficial to both buyer and seller.

That brings us to the second slide of the account planning template: the investment strategy. An investment strategy is essentially a roadmap for the investments you want the company to make over time. Internally, it provides a framework for how you're going to land and expand within the account, but this is also an important external deliverable, particularly for the executive audience. As they don't think about investments in terms of a one-time deal or transaction, executives want to know how their relationship with your company will evolve over time and how the capital investments you're asking them to make will drive the outcomes they're looking for. If you can paint a compelling multi-year vision, it will dramatically improve your chances of getting longer contracts and larger investments.

In an investment strategy, the account's top strategic priorities, objectives, and relevant use cases are organized into topical themes. Your company's use cases will align with each of these themes. These themes are then assigned a horizon based on how the customer prioritizes each outcome. The most urgent outcomes become Horizon 1. Each horizon represents an investment that the customer will make to deliver the themed value to the business. As such, you can then estimate revenue potential for each theme to quantify the total economic opportunity.

To put this into practice, start with your Aligning to Priority slide. That's where you'll find your use cases. Divide these into topical themes that correspond to the relevant strategic priorities and/or operational objectives, such as AI operations or product innovation. Then list out the topical themes in the "Themes" column. From there, list specific performance targets that are related to each theme. These can come from executive guidance and/or investor expectations. Next, in the "Objectives" column, list out some objectives that correspond to the theme and use cases. You should start with relevant objectives from the Aligning to Priority slide, but we also recommend adding in a few of your own to supplement.

Now circle back to fill in your relevant use cases for each line item. Next, fill in the horizon for each item. Remember, this corresponds to how urgent the objective is in the company's list of strategic priorities. The most urgent items are Horizon 1, followed by 2 and so on. Then determine what type of opportunity this is. If you're looking at expanding a current customer's implementation, write "expand." If you're looking at a new opportunity altogether, write "new."

To complete the table, fill in the buying group, as in which organization within the company is responsible for the subjective and performance target. If you're looking at an expansion opportunity, fill in what the customer currently spends on the initiative. Otherwise, you can leave this column blank. Finally, outline the new investment you'd be asking the customer or prospect to make for the purchase.

In this example, our fictitious company Robobrain has several opportunities to help Nike reach a number of important performance targets in the coming years.

Before we close out this section, there are a few best practices to keep in mind when working on investment strategies, both as part of the account planning process and as you continue to develop the relationship with your customer:

- First, think of the investment strategy as a very customer-oriented and dynamic document. You want feedback from them on this so you can get all the details right. Rework the document as needed over time too because priorities do change. If you're just beginning an engagement with an account, use the investment strategy as a qualification tool. Don't proceed with any decision processes until it has been mutually agreed upon with the customer.

- Start with the left side of this slide (your theme, performance targets, objectives, and use cases) to form a mutual agreement with your customer that your use cases are indeed aligned with their priorities. Once everyone's agreed on that, get buy-in on the right half, where you talk about scope, investment, and ROI. If you're initially engaging from the middle up with a manager or director, for example, use the investment strategy as a catalyst to jointly engage executive stakeholders like the SVP or CXO.

- Finally, for customer-facing versions, make sure you adjust the terminology appropriately. For example, if you mention ARR (your internal term), change it to "estimated investment" (what you're asking the customer for).

The Engagement Plan

Map out your detailed next steps, so everyone on your team knows exactly what to do and when to do it.

In the final step of the account planning process, you need to determine how, when, and with whom you will engage to execute your investment strategy. This is called an engagement plan. The first column of the engagement plan is where you list the names of key stakeholders on the account. You can use Databook to help you here, or you can research the right people on LinkedIn or other company data websites. In addition to names, be sure to include each person's title, buyer group or region, tenure, and horizon.

The horizon refers to the investment horizon in which they will be a key stakeholder. Just because a stakeholder is not in Horizon 1 doesn't mean you shouldn't engage them, especially if you're doing cold outreach to a new account. You never know where your first response will come from, and it's likely you'll need to adjust your horizons in the investment strategy based on where you get traction first.

Relationship is a basic barometer of the strength of your current relationship with the stakeholder. For example, would you characterize the relationship as strong, medium, or weak? Finally, provide a summary of next steps for each stakeholder, outlining how you plan to engage or the next actions you need to drive with them.

In the example of Robobrain, several strategies are at play, such as ghostwriting an email for Robobrain CEO to send to Nike's CMO and getting warm introductions from co-workers. Developing an effective account plan is one thing, but you need a strategy for how to engage your client. So, don't forget this crucial step.

When to Use Your Account Plan

See how a solidly crafted account plan comes into play throughout the sales cycle.

You've now seen how each slide in the template should be completed as part of the account planning process. Let's go back and look at how it all comes together.

First, you and your team will do detailed research to document the customer's strategic priorities and objectives, and then you'll align these items directly to your solution's use cases. This shows you ways you can connect your offerings specifically to the customer's current pain and urgency.

Next, you'll outline an investment strategy that, when used internally, provides a framework for how your company can land and expand the account. With a few simple adjustments, you can also use this externally as an executive deliverable that demonstrates how the company's investments map to a strategic relationship evolving over time.

Finally, you'll draft an engagement plan that specifies how, when, and with whom you'll engage to execute your investment strategy. Approaching your account planning in this way is so valuable because it makes up the bulk of a strategic approach to customer relationships. Ultimately, this exercise helps you answer four critical questions that you should come back to during every step of the sales process:

1. Understand your customers' needs, goals, and priorities.

2. Align your solutions to those priorities.

3. Map the investments you'd like customers to make.

4. Identify the people you need to engage to drive those investments.

So, when should you be using this to get the most out of your time and effort? Create and use this template when you're researching a new account or planning expansion potential with existing customers. You should continue to update this document throughout the year when you have new information. Consider it the touchstone of your account strategy – nothing works or proceeds without it.

You should also be using the data from the account plan, as well as a customer-facing version of the priority slide when you're meeting with mid-level stakeholders so you can verify their strategic priorities and keep your strategy current. Whenever you learn new information or priority shifts, update the account plan accordingly.

And you should use a customer-facing version of the investment strategy slide when meeting with senior stakeholders as a foundation for executive conversations. Gather feedback from the customer and use the document as a way to ensure both parties are ready to move forward with the relationship.

The more you practice building and working with this type of account strategy, the better your team will get at building long-term high-value strategic relationships over time.

Ask an Expert

You're well on your way to account planning mastery. Want 1:1 support from sales pros as you build your account plan?

Don't miss our next sales expert AMA. You can ask for specific tips on your planning process.