Account Planning Template

Get the Latest Template

An account plan is your roadmap to a high-value deal—so it’s important to get the details right if you want to build a successful strategic relationship with your customer. This template is designed to effectively document your research and present your strategy, covering every base to ensure executive relevance, financial viability, and a clear path forward.

Pro tip: As you build your account plan, remember the following elements are all critical components to completing this template:

- Strategic priorities. These are the client’s core business drivers.

- Business goals. Where would the client like to be in a quarter, six months, and a year? What targets have they set?

- Competitors. Comparative standing among peers is a huge motivator for the C-suite.

- Challenges. The main obstacles the client faces in growth and meeting goals.

- Purchasing & budget parameters. How and when are the client’s major purchases typically made?

- Decision-making processes. Who is involved in decision-making, procurement, and timelines?

- Guidance on how to retain and upsell. For existing clients, include strategies on how to increase your value.

This account planning template includes three slides. Here, we’ll walk through the first pivotal slide around your customer’s strategic priorities to get you started. For more in-depth information, head to our complete Account Planning video series, where we dive into each slide in greater detail.

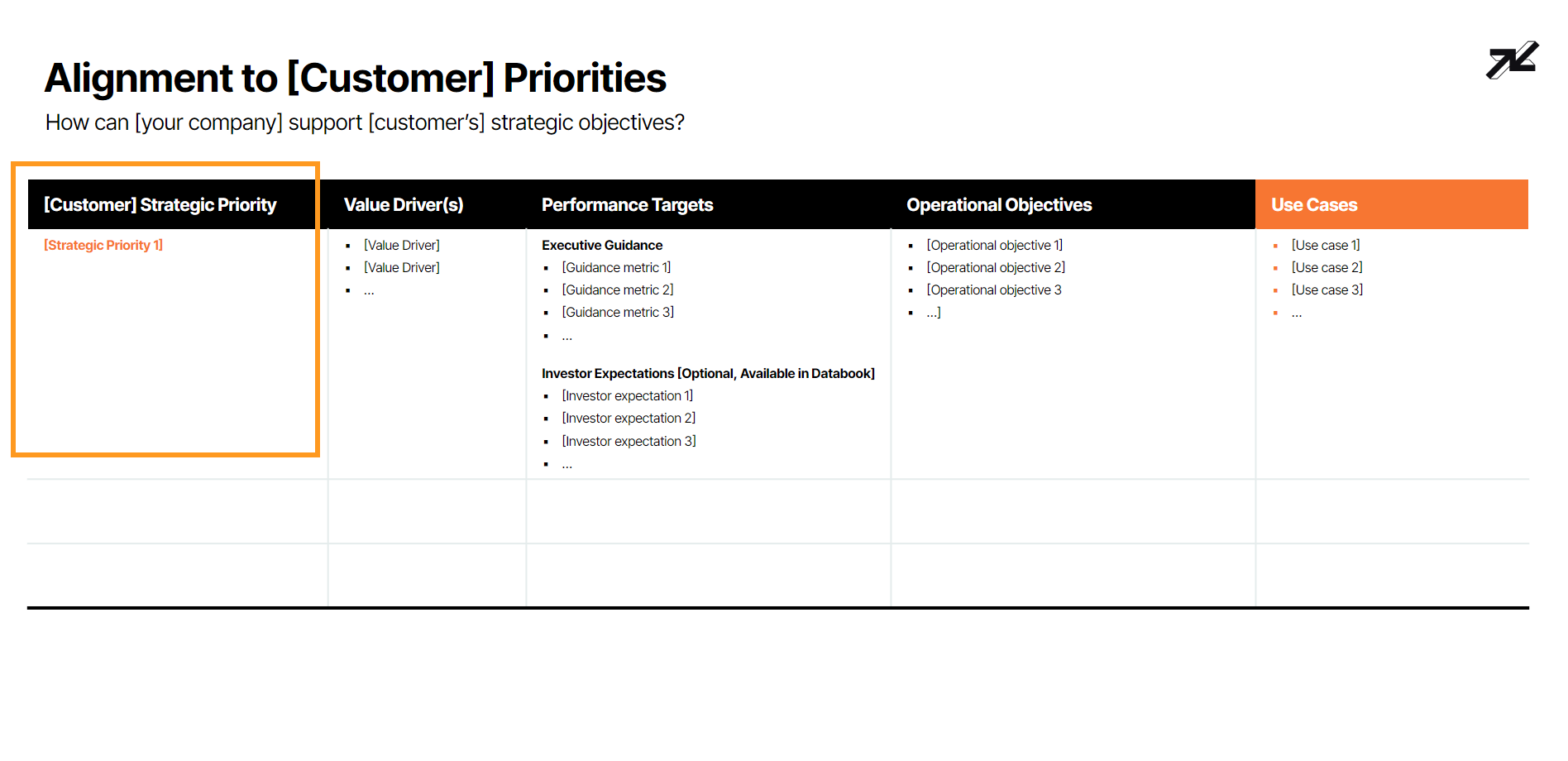

Outline the Business's Priorities

First, list the client’s strategic priorities. Start by reviewing the business's earnings presentations, listening to investor calls, and looking at pitch decks. As you research the client’s business, aim to answer the following questions:

- What KPIs do they measure?

- What are their current plans to achieve these goals?

- Will they continue with key initiatives?

- What are their goals?

- What do they value the most?

- What’s stopped them from achieving targets in the past?

Research can definitely be a bear—but you do have options to simplify the process and save time. For example, Databook provides one-click access to a company’s strategic priorities that your team members can use to fill in any gaps in the account overview.

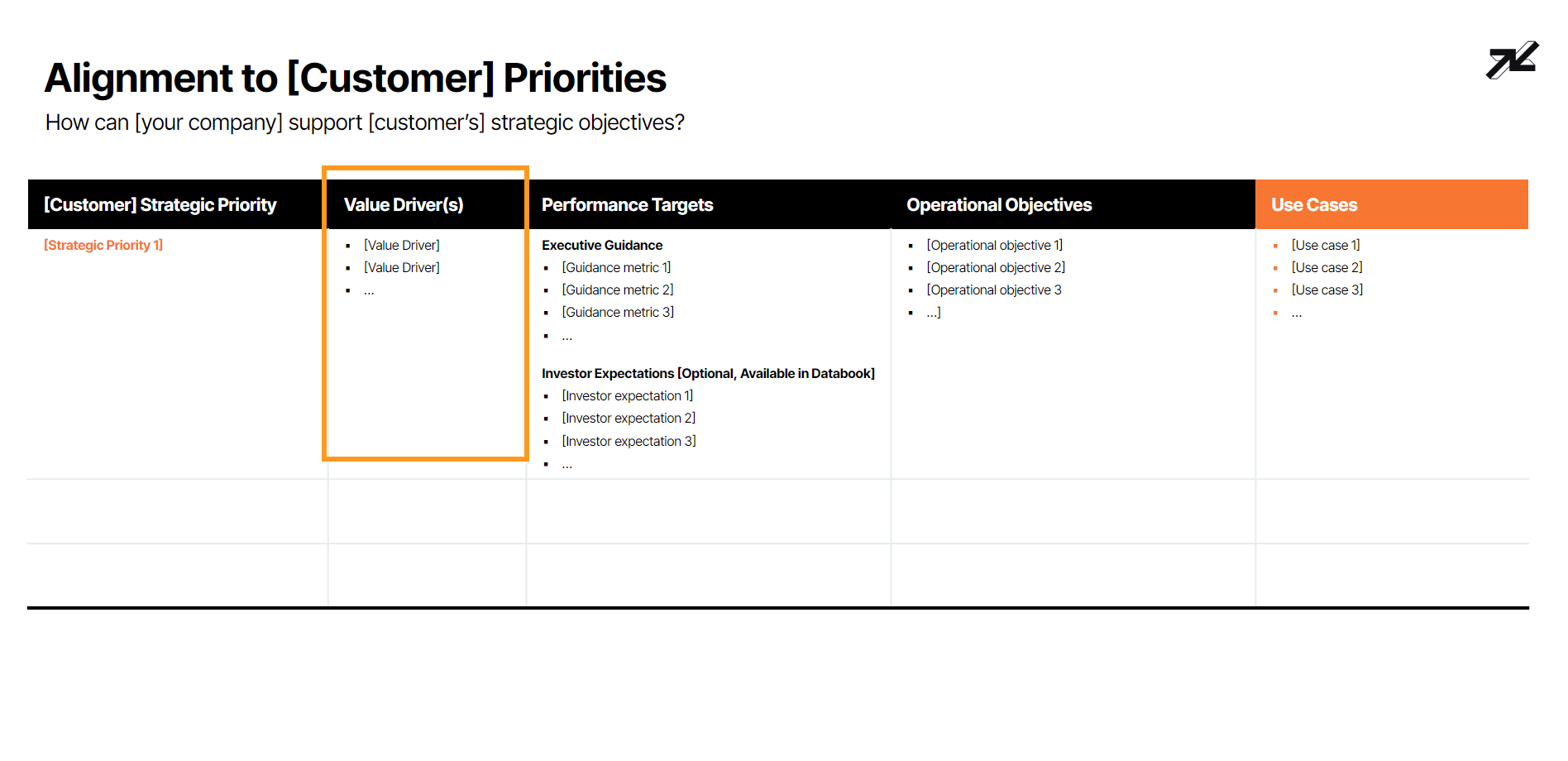

Next, Dig into Their Value Drivers

78 percent of buyers say purchased solutions were not superior to competitors’ offerings. Instead, other factors like insights and cultural alignment drove the decision to buy.

The best sales teams and account managers deeply understand their customers’ values. They ask stakeholders value-focused questions to uncover the core of their business objectives. This search for values must be ongoing too—businesses often shift values as a result of market and industry landscape changes.

In this step, list out the value drivers that the strategic priority impacts:

- Target markets in the client’s industry

- Client’s vital numbers

- Client’s annual revenue

- Client’s vision

You should also create a subgroup of the top-line financial metrics that boost shareholder value in the company’s industry, including:

- Growth

- Gross margin

- SG&A

- Capital efficiency

For existing client relationships, make this step a collaborative process and directly ask the decision-maker for these numbers.

If you start from scratch, it’s easy to use an SRM platform like Databook to generate a value driver tree for each business’s industry.

For example, let’s say a company has a strategic priority called “Create a superior customer experience” aimed at driving deeper engagement and customer loyalty. This strategic priority directly impacts customer acquisition, retention and lifetime value, which, in turn, drives Revenue. Therefore, the associated value driver for this strategic priority would be revenue growth.

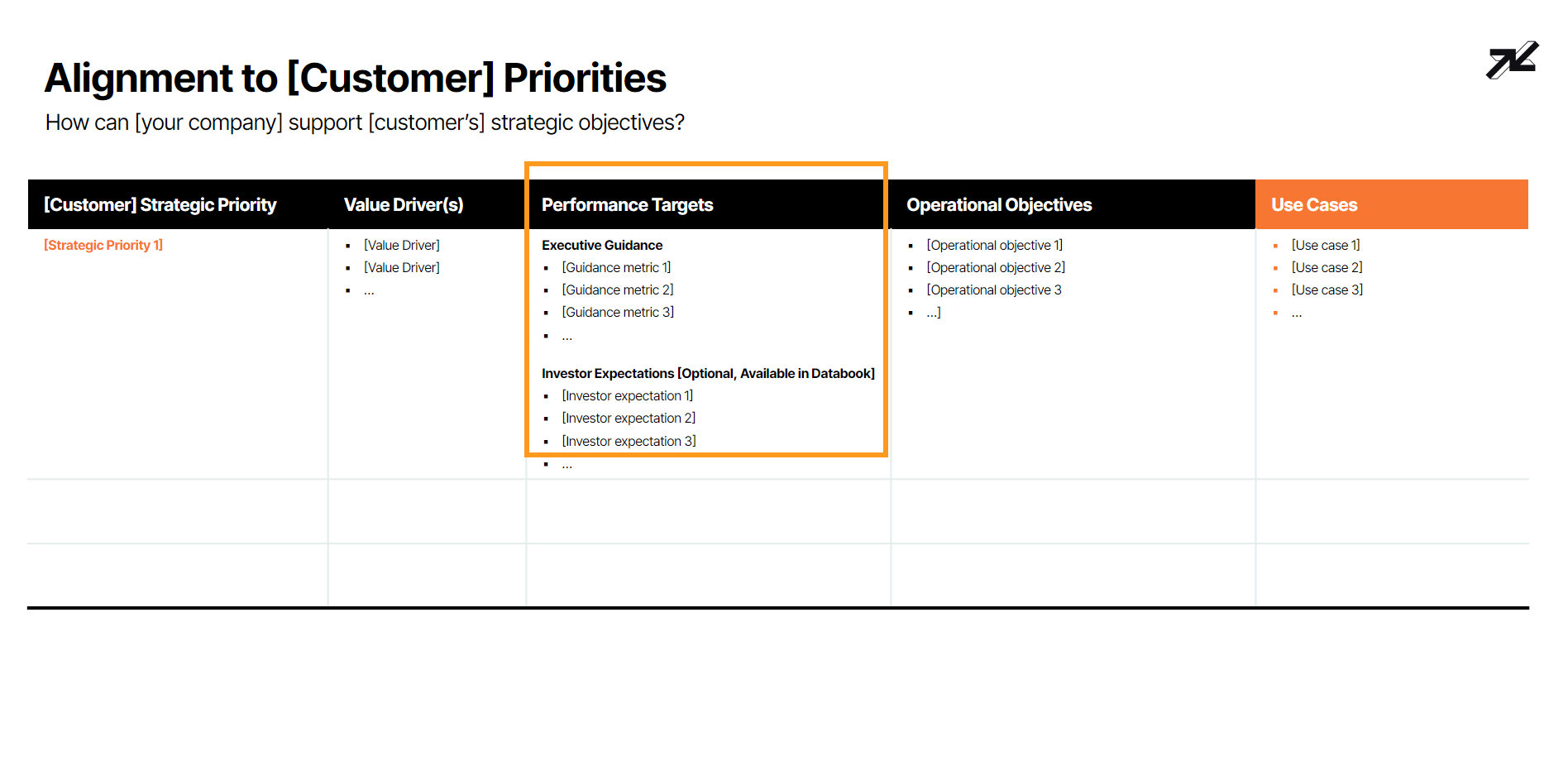

Include Specific Performance Targets

As part of your drive to identify what matters most to clients, write out any key performance targets that executives have said align with the value drivers you listed.

The best way to find these is to review earnings call transcripts. Pay special attention to the transcripts for Q4 and Q1 where executives (typically the CFO) often provide their guidance for the fiscal year ahead.

You can find earnings call transcripts for public companies on sites like the New York Public Library and MarketBeat.

But it’s much quicker and easier to do this in an SRM platform like Databook that presents easy, centralized access to all of the company’s earnings call transcripts (as well as regulatory filings, investor presentations, and other disclosures). And don’t forget to include investor expectations in this section, too.

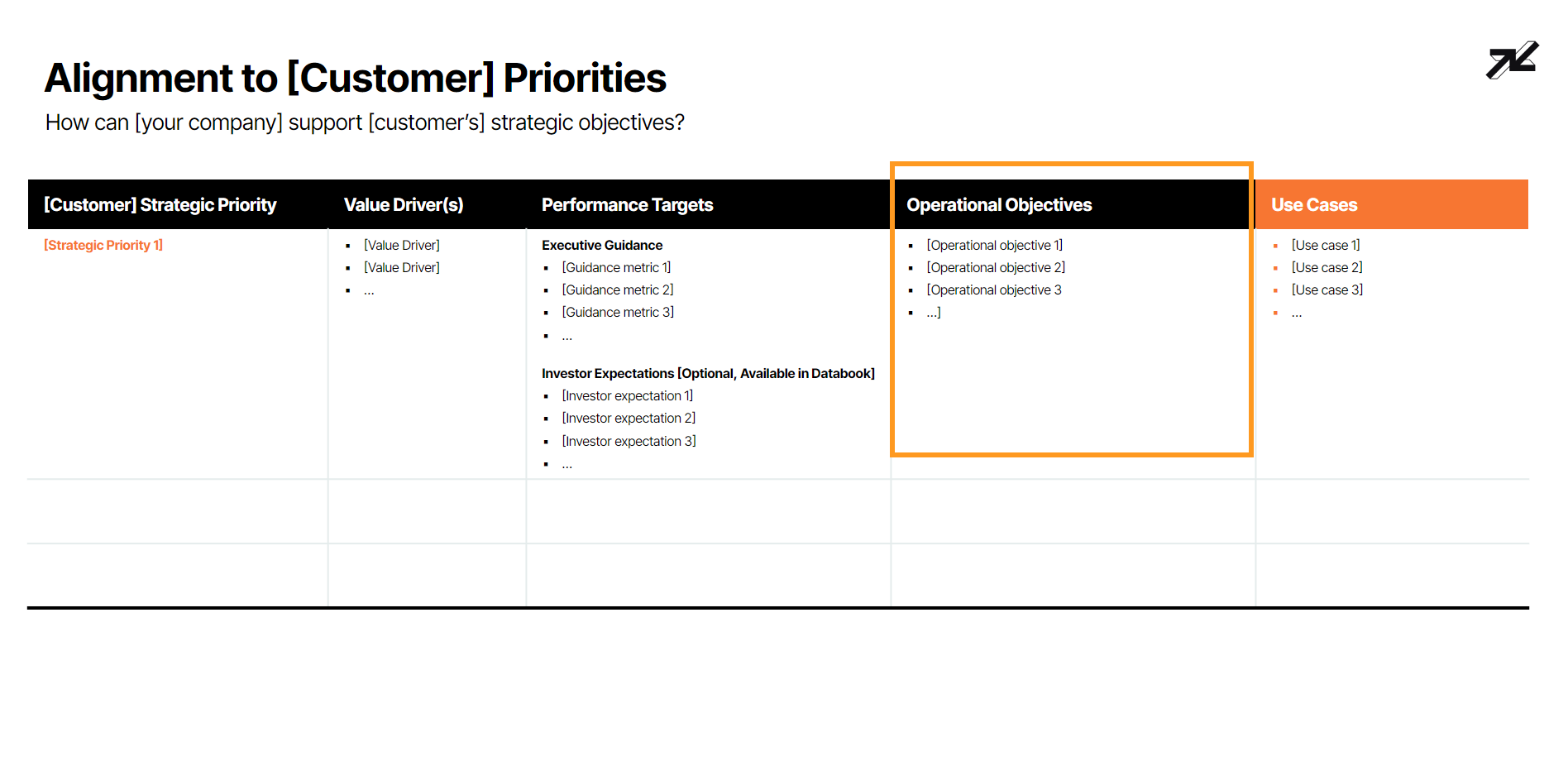

Review Your Client's Operational Objectives

Write out the specific tactics that executives have stated will help them hit their performance targets and achieve their strategic priorities.

Just like performance targets, earnings calls are a great place to find this information as executives will often use that outlet to discuss the specifics of their operational plan. For example, they may explain the logic behind their decisions and goals as such: “We’re going to leverage enhanced data and analytics capabilities to optimize inventory, drive higher full price realization and lower digital fulfillment costs. As a result, we’re hoping to achieve gross margins in the high 40% range by FY25.”

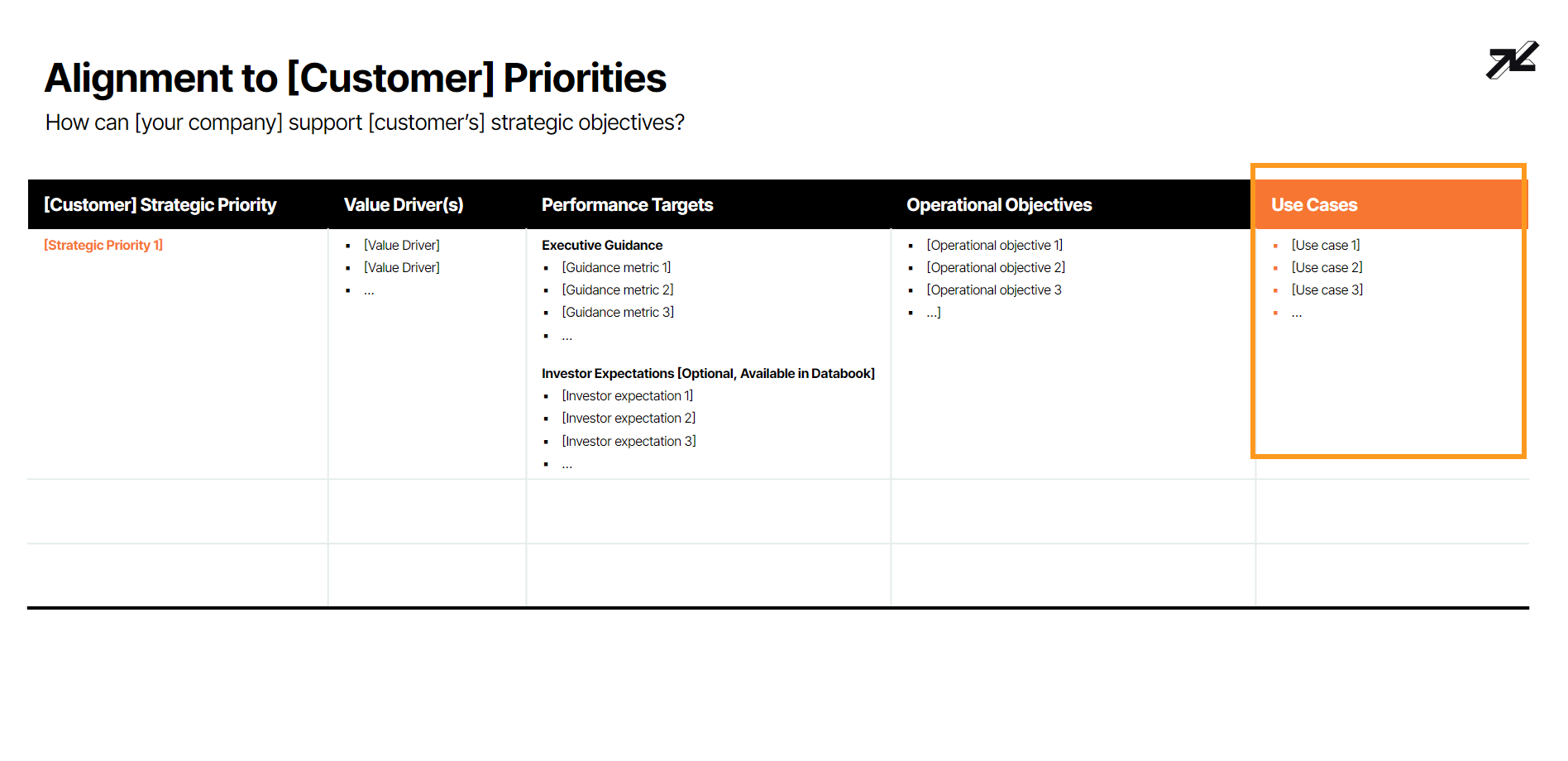

Identify Use Cases That Show How You Can Help

Once you’ve gathered all client-specific data, it’s time to determine the products and services that match your clients’ needs and build an action plan.

Identify those specific product or service use cases that align with the company’s strategic priorities, value drivers, performance targets, and operational objectives.

As part of this process, identify the following:

- Client needs for products/services

- Annual revenue goals

- Opportunities for cross-selling and upselling

- Barriers and limitations

- Operational restrictions

You can find this data online in a variety of financial reports, but access is far faster using technology like Databook. The platform automatically curates a list of your relevant use cases on the company’s Highlights page and assigns a Match Strength Rating (Strong, Medium, or Weak) for each use case. There’s also a mapping to specific value drivers and strategic priority keywords to help you select the right group of use cases.

Include as many use cases as you think are relevant––the number of use cases is directly proportional to the size of the opportunity and the potential value for the customer.

Then for each use case, identify the following:

- Possible objections. For example, negative investor sentiment or onboarding complexity.

- ROI potential. The revenue your solution could generate for them.

- How you’ll address objections. The steps your team will take to remove uncertainty.

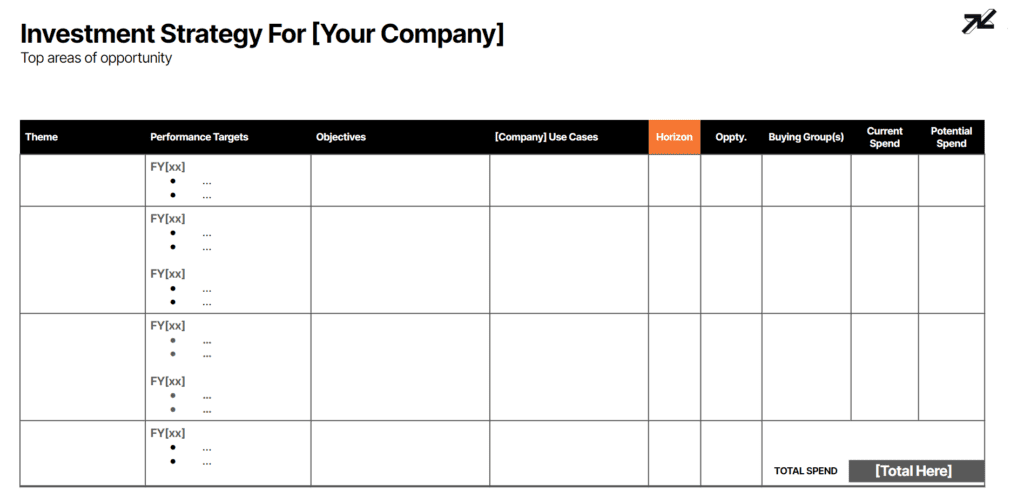

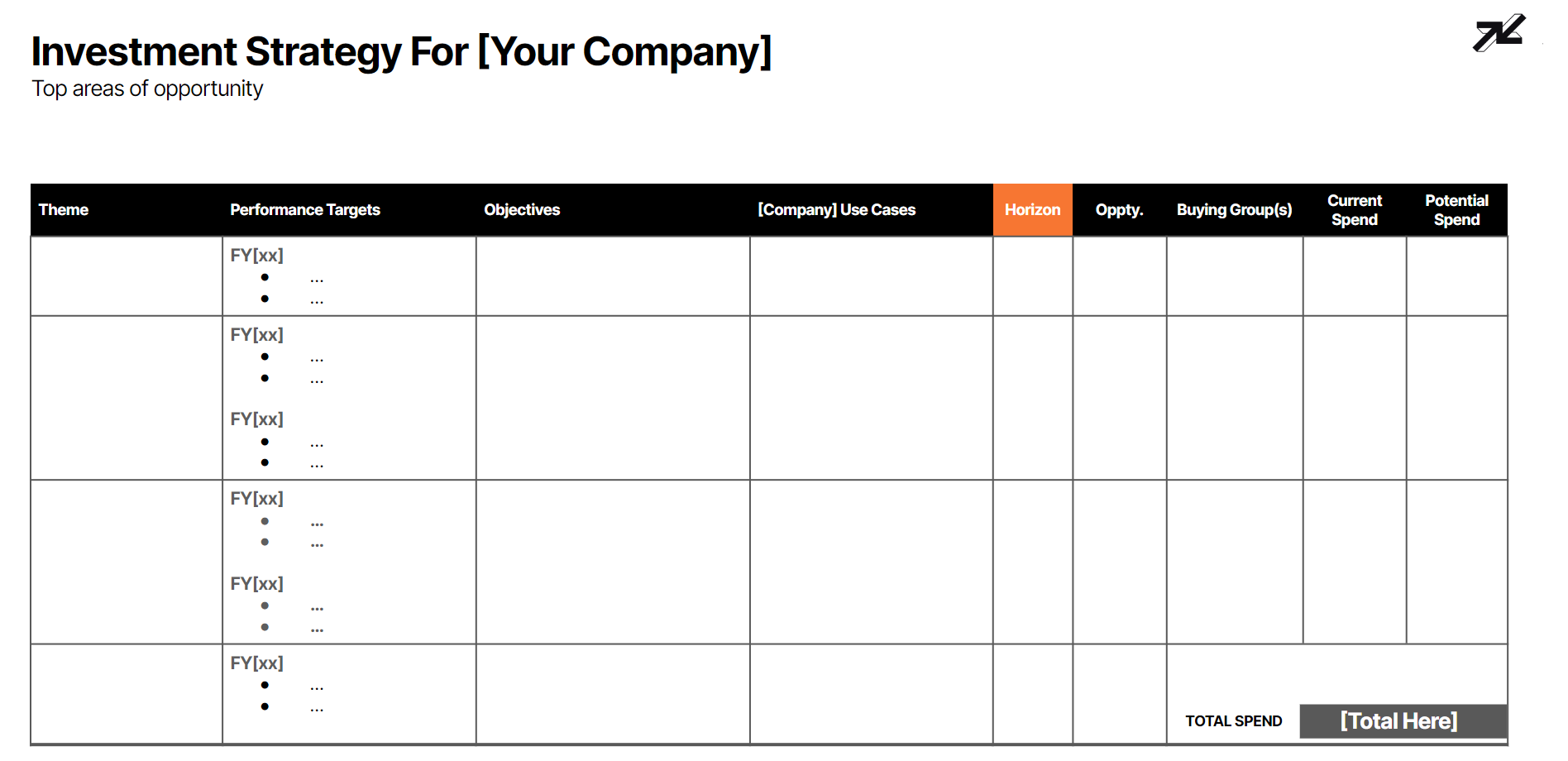

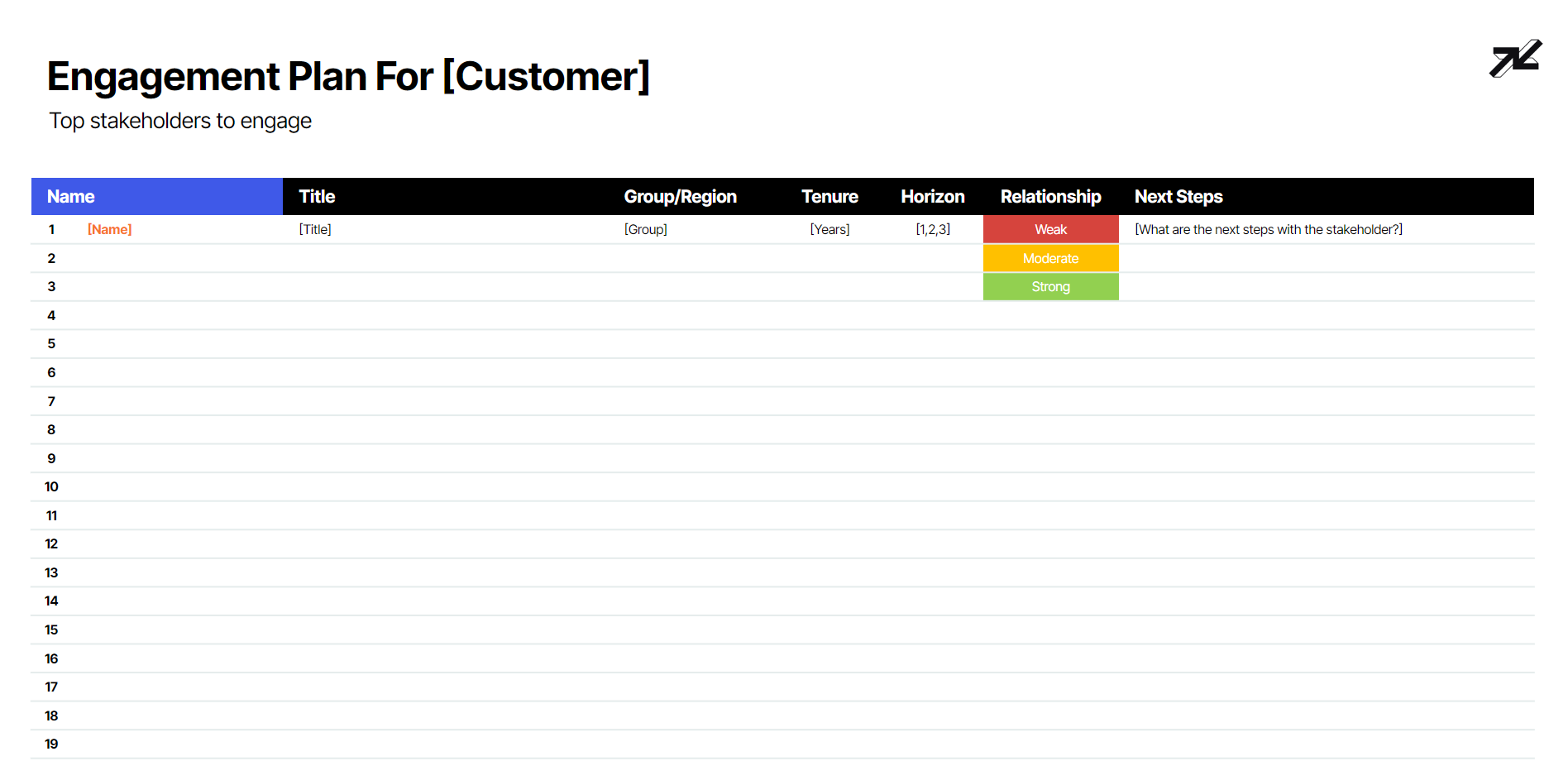

Investment Strategy & Engagement Plan

These slides are outlined with specific examples in our complete Account Planning video series. The goal here is to provide your customer with a clear path for how your strategic relationship will unfold to best meet their stated financial performance objectives—and then document exactly how you’ll begin outreach to start your deal with the right champions early on.

Update Your Account Plan Regularly

Remember, completing an account plan isn’t a one-and-done exercise. To become a trusted client partner, your plan must evolve alongside client needs. Bake in regular account plan updates to keep your client informed and to adapt to any changing priorities.

Here’s an example review schedule you could adopt:

- Bi-weekly. Send out a short email status update on your current plan.

- Monthly. An account plan update call with the client to review objectives.

- Quarterly. Build a written progress report that includes recent success, obstacles, unexpected events, new opportunities, and decisions needed to move things forward.

To ensure your account plan is relevant, make sure it’s aligned with your customer’s business. Always add fresh performance data, changing priorities, and any client feedback.